Beyond Balikbayan Dreams: Rethinking Filipino American Wealth

Written by Clifford Temprosa

Our parents dreamed of retiring in the Philippines. But if we only buy condos we rarely live in, we’re not building wealth - we’re burying it.

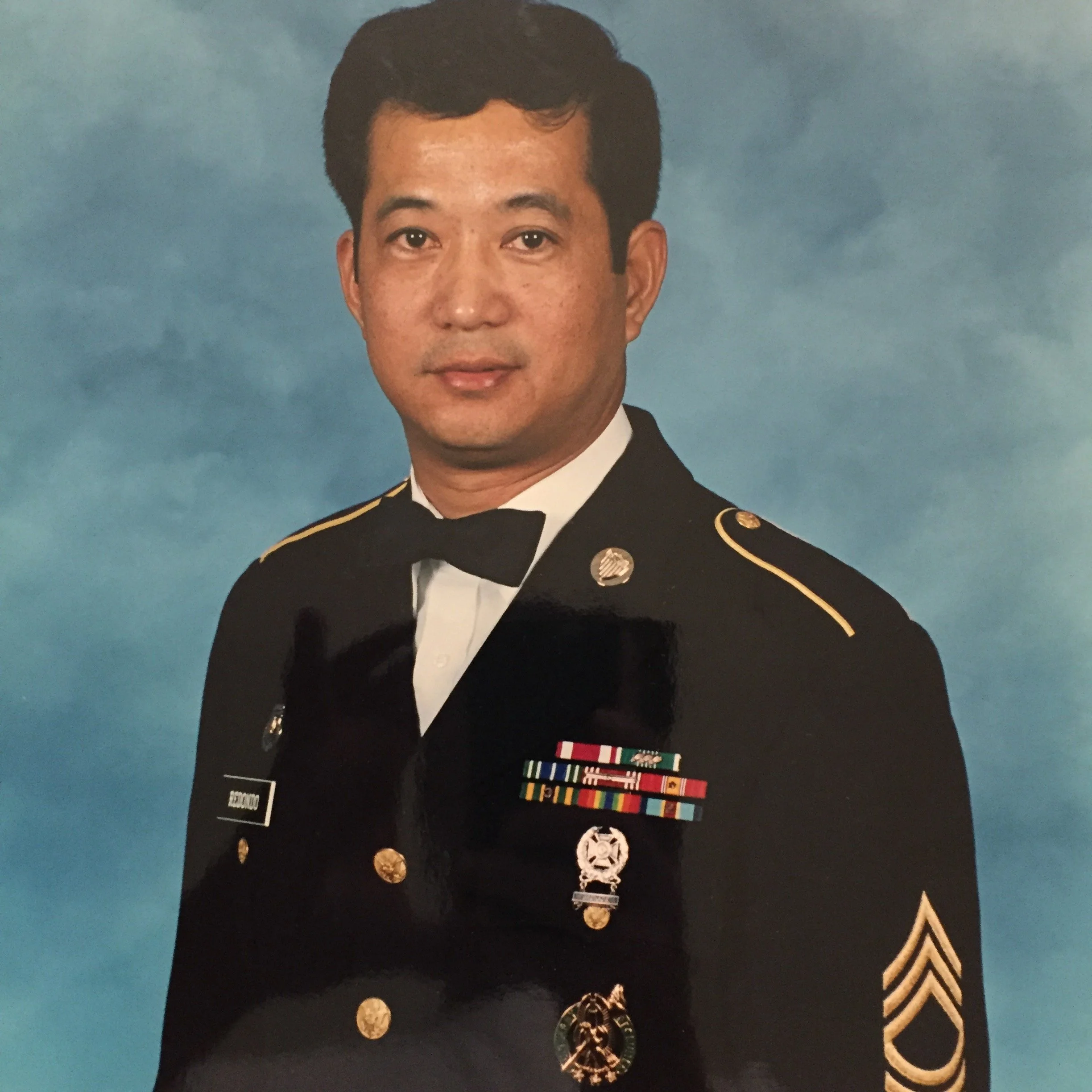

The Quiet Currency of Sacrifice

Every December, airports from LAX to JFK fill with balikbayans wrapped in duty-free luggage and quiet pride. Boxes marked Fragile and For Lola overflow with chocolates, sneakers, vitamins, and the unspoken weight of obligation. These are not just gifts—they are economic love letters.

For generations of Filipino immigrants, money has never been just about survival. It has been about care - remittances that keep the lights on for family, tuition payments that buy futures, and the shared dream that one day, after decades of work in a foreign land, they could return “home.”

But what if that dream, noble as it is, has trapped us in a cycle of sentimentality disguised as strategy? Because somewhere between survival and success, we stopped asking whether the way we save actually builds the power we need.

The Nurse and the Son

Take Maria, a nurse in Jersey City. For twenty years she has sent money to her siblings in Quezon City and paid off a Taguig condo she rarely visits. It stands immaculate and empty - her reward for sacrifice. Yet on night shifts, Maria dreams of opening a small home-care agency that could employ other Filipino nurses and keep families together. Her savings are ready, but her confidence is not.

Across the river, David, her second-generation son, has a different vision. He wants to convert his parents’ next real-estate purchase into seed money for a family-run café that celebrates Filipino flavors and creates jobs in their neighborhood. Two generations, one dream: security that means different things. Maria builds for return; David builds for root. Their story is our story.

The Mirage of the Balikbayan Dream

Owning property in the Philippines became a symbol of success, the ultimate proof that migration was worth it. For many, buying a condo in Quezon City or a house in Cavite isn’t just an investment. It’s an emotional insurance policy.

Yet for too many families, those properties sit empty. They generate no income, no appreciation, and no social infrastructure that strengthens the community where we actually live.

That’s the irony: our diaspora funnels billions back into a homeland economy while often neglecting the ecosystems around us - the neighborhoods, businesses, and organizations that shape our daily lives in the U.S.

We call it loyalty. But sometimes, it’s loss disguised as love.

The Hidden Cost of Trust

Behind the glossy billboards and expo booths selling “retirement in paradise,” a quieter crisis brews. Across Filipino enclaves from Daly City to Dubai, developers and financial brokers aggressively market pre-sale condos and investment schemes to overseas workers and their families. Promised easy payments, guaranteed returns, and “forever homes,” many buyers sign contracts they barely understand.

Few realize that these deals often demand balloon payments, high-interest financing, or currency conversion losses. By the time the property is paid off, oversupply has eroded its value. What was meant to be inheritance becomes inventory.

The same vulnerability extends to financial “advisors” who recruit relatives into pyramid-style insurance or investment networks. Entire savings vanish into schemes that reward recruitment more than return. The pain is not just monetary - it’s moral. Trust, the most Filipino currency of all, becomes collateral.

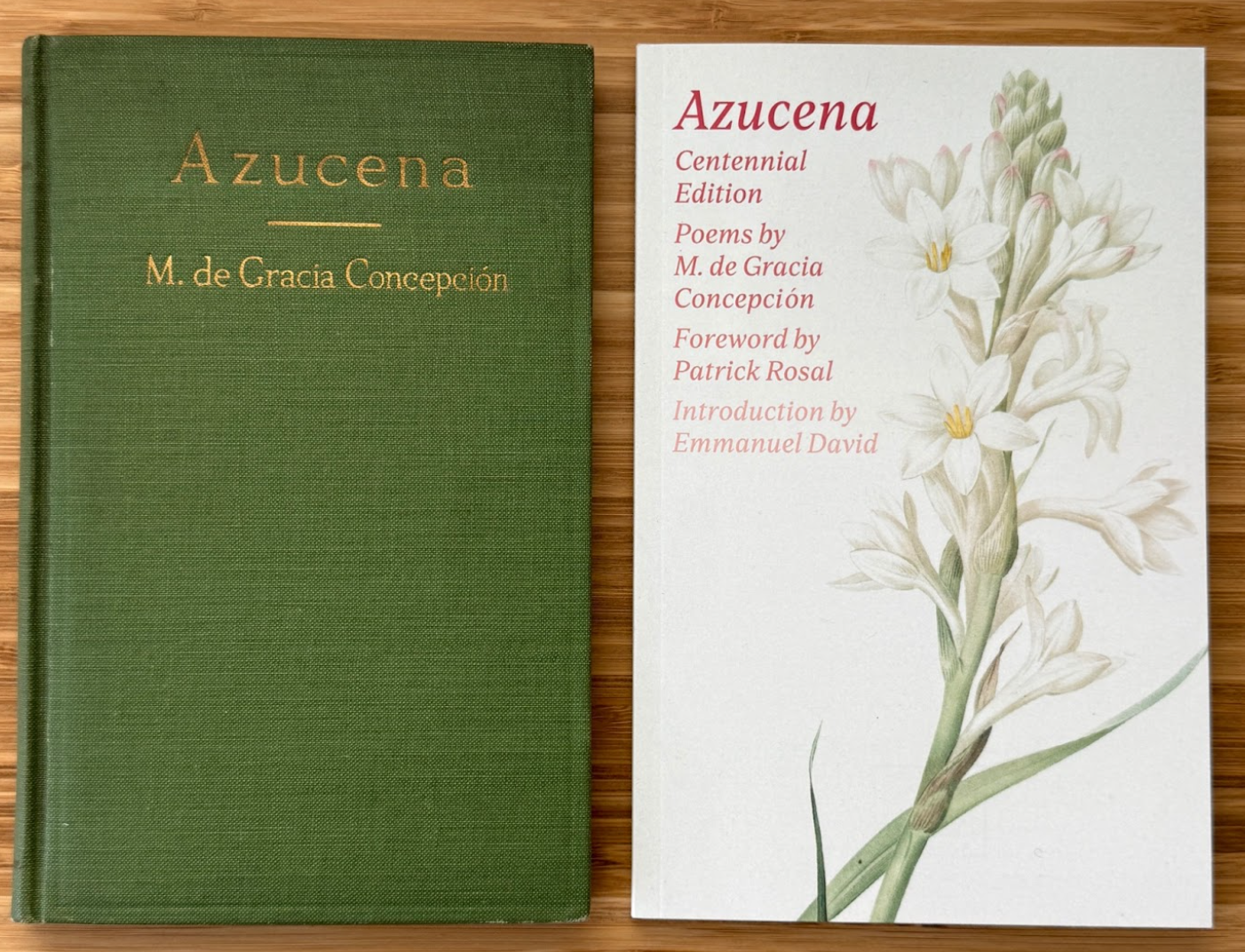

At its core, this isn’t greed. It’s illiteracy - systemic, inherited, and unaddressed. We teach our children calculus but not compound interest. We can recite poems by heart, but not our own loan terms.

Until financial literacy becomes as sacred as family duty, we’ll keep confusing paperwork for progress.

A Flash of Data

According to Pew Research and the Federal Reserve’s Survey of Consumer Finances, the median Filipino American household holds less than half the net worth of Indian and Chinese American households, despite similar education and employment levels. World Bank data shows Filipinos sent over $38 billion home in 2023 alone - 4th highest globally. Economist Dr. Maria Cristina Cabral calls it “a transfer of potential capital from diaspora to dependence, a beautiful gesture that rarely builds power where Filipinos actually live.”

Wealth Without Circulation

Filipino Americans are one of the most educated and employed Asian subgroups in the United States - yet we rank below the median in household wealth. Not because we lack discipline or work ethic, but because our money doesn’t multiply where we live.

We save religiously. We buy what feels secure. But a stagnant condo isn’t wealth. A 401(k) that can’t be touched for decades isn’t power.

Real wealth circulates. It creates jobs, builds businesses, funds scholarships, and opens doors for others. It generates decision-making power.

Because when you have capital, all you need is to make decisions.

Capital as Choice, Entrepreneurship as Freedom

Starting a business isn’t just an act of ambition, it’s an act of liberation.

A café that employs Filipino youth. A wellness studio that centers Asian healing. A tech startup founded by second-generation immigrants who understand bilingual markets.

Every enterprise is more than income - it’s infrastructure. It keeps dollars circulating within the community. It transforms consumers into owners. It turns cultural pride into economic agency.

For every Filipino nurse who dreams of opening a care agency, for every family with savings sitting idle in low-interest accounts, for every youth wondering if their parents’ sacrifices can turn into something more - entrepreneurship is the bridge.

Because entrepreneurship teaches the same values our parents lived by: discipline, resilience, and service. But it adds one ingredient they were never taught to pursue - ownership.

Nostalgia Isn’t a Business Model

The impulse to buy “back home” isn’t misguided. It’s emotional truth: the desire to stay connected to a place that raised us. But when nostalgia becomes our only investment strategy, we risk mistaking memory for growth.

Every dollar wired abroad strengthens the sentimental tie, but not the systemic one. Our remittances sustain individual families, yet rarely shift the economic structures that made migration necessary in the first place.

What if, instead of only sending money to our homeland, we invested like we intend to stay?

What if we created Filipino American credit unions, real estate collectives, and cooperative community funds, where money builds both stability and solidarity?

Because the homeland deserves our love, but the future demands our strategy.

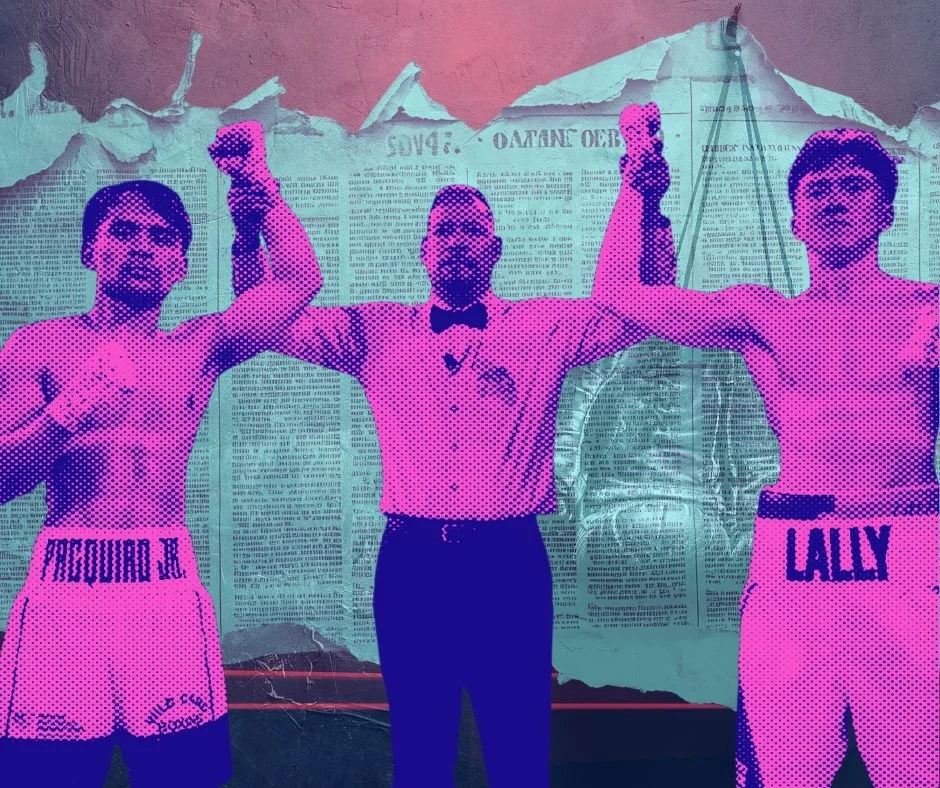

Historical Lineage: The Colonial Price Tag

Our relationship to wealth did not begin in America. Under Spain, we were taught that prestige was proximity to whiteness; under America, that it was productivity. Either way, our value was measured externally. We inherited a centuries-old lesson: status protects, and display defends. The mansion in Quezon City and the designer bag in New York are descendants of that colonial instinct - proof of worth in a world that once denied it.

The Economics of Belonging

The Filipino diaspora sends over $38 billion to the Philippines every year - the fourth highest remittance flow in the world. That’s not just generosity. That’s power. But it’s power we’ve learned to give away.

Imagine if even a small fraction of that were redirected into Filipino-owned enterprises in the U.S. - restaurants, consulting firms, production houses, grocery chains, daycare centers, or legal cooperatives.

Those ventures wouldn’t just create income. They would redefine what it means to belong - to claim economic space in a country that still often sees us as invisible.

Wealth is political. It determines who funds campaigns, who builds schools, and whose voices echo in boardrooms. If Filipino Americans want to shape the systems that shape us, we must own more than labor. We must own leverage.

The Generational Divide

Talk to any first-generation parent and you’ll hear the same refrain: “Anak, just save. Don’t take risks.” Their fear is born from survival, not scarcity. Risk meant hunger. Stability meant dignity.

But for second- and third-generation Filipino Americans, the question is shifting: “How do we build beyond survival?”

That’s where the intergenerational tension lies, between a generation that worked for stability and one that longs for scalability. Between parents who equate security with silence and children who equate legacy with leverage.

Bridging that divide requires conversations that are tender, not transactional.

Ask your parents:

● What if “retirement” wasn’t a destination, but a platform?

● What if the money they saved could start a business for you or your siblings?

● What if their hard work could fund something that keeps giving back - a scholarship, a storefront, a cooperative?

Legacy is not what you leave behind. It’s what you set in motion.

Cultural Values, Economic Futures

This isn’t about abandoning Filipino values. It’s about translating them into modern tools.

● Bayanihan becomes community lending.

● Utang na loob becomes mentorship.

● Pakikipagkapwa becomes collective investment.

● Hiya becomes accountability in financial transparency.

We don’t have to choose between culture and capitalism. We can practice cultural capitalism. One rooted in ethics, equity, and empathy.

The Price of Prestige

Here’s another truth we rarely say out loud: we love the symbols of success more than the systems that create it.

The Louis Vuitton bag, the Balenciaga slides, the new iPhone, the destination wedding, the high-rise condo that stands empty half the year. All of it whispers the same thing: “I made it.”

There’s no shame in wanting beauty, recognition, or comfort. These are the rewards of survival. But somewhere along the way, the Filipino community’s relationship with status became performative, not productive.

We were taught to measure worth by what can be displayed, not what can be sustained.

Imagine if the ₱150,000 spent on designer bags each year became seed capital for an online business. If the cost of one luxury car lease went into a food truck that employs local youth. If the latest gadget upgrade became a down payment for a small property shared among siblings.

We already know how to save, how to sacrifice, how to give. What we need to relearn is how to multiply.

Because wealth that sits in closets, not communities, dies in silence.

This isn’t a call to shame. It’s a call to shift. The same desire that drives us to look successful can drive us to become successful - when it’s tied to ownership, not optics.

True prestige isn’t what you wear. It’s what you build.

Reimagining Diaspora Power

If wealth-building is a form of self-determination, then Filipino Americans must redefine what we mean by “success.”

Success is not measured by how many balikbayan boxes we can fill, but by how many lives our dollars can lift. It’s not how much property we own abroad, but how much prosperity we generate at home. Wherever home now is.

The diaspora is not just a source of remittances. It is a potential republic of thinkers, builders, and investors. People who can bridge nations through shared prosperity.

We can love the Philippines without losing ourselves in it.

The New Balikbayan

Perhaps the new balikbayan isn’t the returning migrant at the airport. It’s the entrepreneur opening a Filipino-owned business in Los Angeles. It’s the young professional buying property with friends to rent to immigrant families. It’s the collective of nurses investing in a health-tech startup for communities of color.

The new balikbayan doesn’t just send money back. They send power forward.

Reinventing Wealth

We honor our parents not by repeating their patterns, but by reimagining their possibilities.

They built for survival. We can build for sovereignty.

It begins with literacy - financial literacy that demystifies investment, credit, and cooperative ownership. It expands with representation - Filipino financial advisors, investors, and mentors who understand our cultural values. And it flourishes through community - chambers of commerce, nonprofits, and networks that make wealth a collective project.

The balikbayan box is full. It’s time to unpack what’s inside.

Building Power, Not Just Property

At the end of the day, our generation must choose what kind of wealth story we want to tell.

Do we want to inherit empty homes overseas, or thriving ecosystems here? Do we want to be known for sending money, or for creating movements? Do we want to leave behind condos, or communities?

The call isn’t to abandon our roots. It’s to plant new ones.

Because the question is no longer “When will we go home?” It’s “How can we make where we are feel like home. And make it thrive?”

The Economics of Love

Love built this diaspora. The love of parents who left, the love of children who remember, the love of a people who keep giving even when the world forgets them.

But love alone doesn’t build equity. Strategy does.

So start the business. Invest in your community. Talk to your parents. Teach your children that money is not shameful when it circulates toward justice.

At the airport next December, a balikbayan box slides across the counter. But this time, it’s not filled with chocolates or sneakers. It carries something heavier: business plans, cooperative charters, equity proposals. The paperwork of a people finally investing in their own future.

Because Filipino wealth was never meant to be silent. It was meant to be shared.

And the moment we realize that, we stop being just senders of money. We become builders of a future.

When the Avengers: Doomsday one-year countdown dropped, audiences didn’t just watch. They paused, replayed, shared, and even speculated about hidden messages. A week later, the clip surpassed 14 million views, becoming a viral moment picked up across major media outlets that fueled anticipation for the next chapter of the Marvel Universe.

The countdown video was the result of a collaborative effort led by AGBO and its studio partners. Supporting the marketing team as a contracted editor was Joshua Ortiz (@joshuajortiz), a Filipino American filmmaker whose career has steadily built toward opportunities to contribute to projects of this scale, alongside earlier success with the short films he has written and directed.