This One Conversation Could Change How Filipino Americans Think About Money

Licensed Financial Pro Rod Magsino shares the advice his father—a Filipino immigrant doctor—gave him that flipped the script on the American Dream. What he says might surprise you.

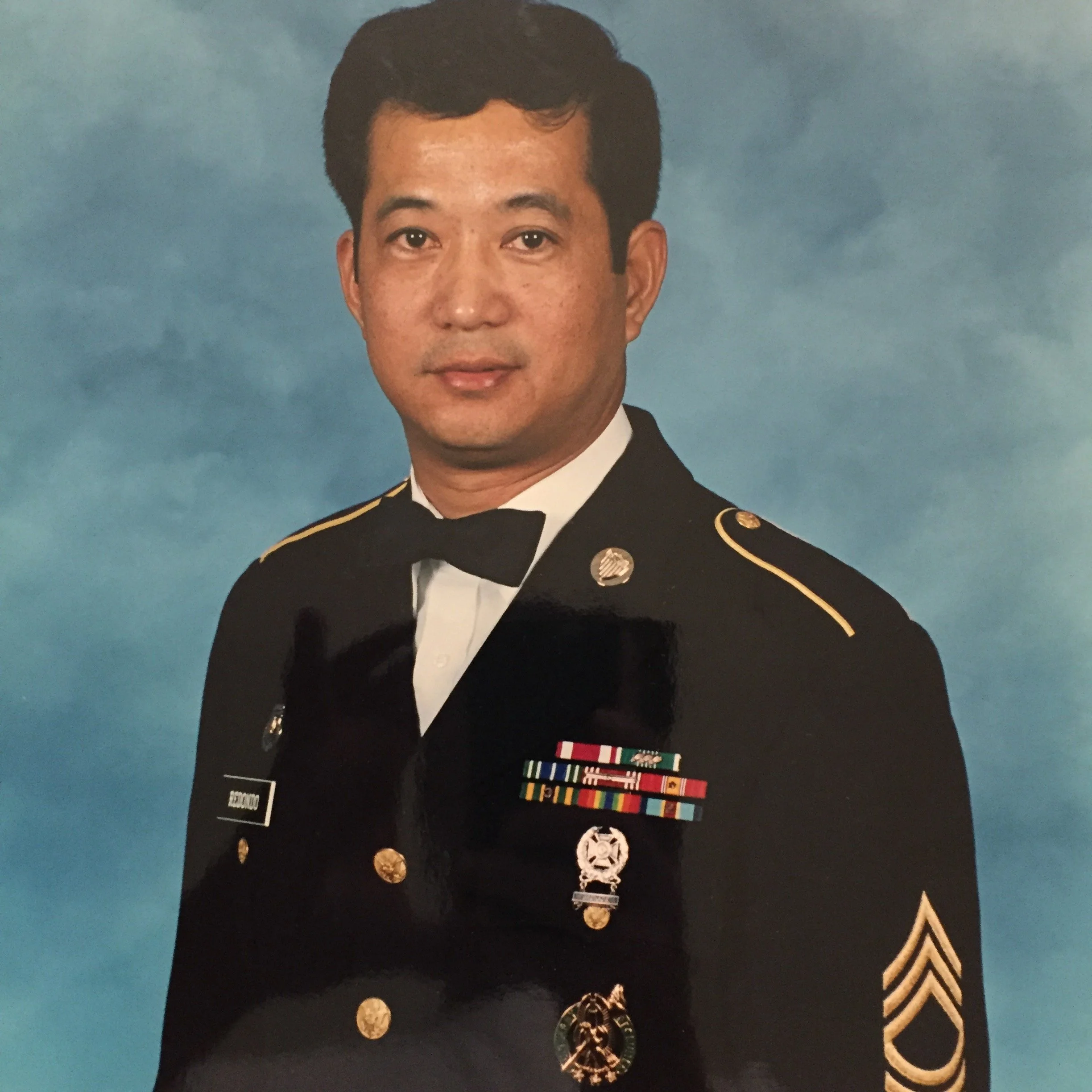

By Jennifer Redondo

July 31, 2025

I’ve said this before, but an important role that you need in your squad is a financial professional. It’s important to find someone you like, someone you can trust, and most importantly, someone who has your best interests at heart. I want to introduce you to someone that my family has entrusted with our finances for many years, Rod Magsino. I have known Rod for over 25 years when we first was introduced to him by my late mom, a retired Registered Nurse who worked with Rod’s dad, Dr. Magsino.

Growing up, we rarely talked about money. Truth be told, my mom was not very good with her finances. She knew how to make money, but she also knew how to spend it. She didn’t know how to save and she was really bad at remembering to pay her bills on time because she was too busy working or too tired from her evening shifts. Though, through the grace of God, Rod entered our lives and has opened up indispensable discussions about our finances. He helped my sister and I get our jump start into investing at a very young age. We are thankful for his services, and most of all, we are grateful for having a trusted confidant that we could turn to – in times of struggle and abundance.

“I DON’T WANT YOU TO BE IN MY SHOES AT MY AGE WORKING FOR MONEY.”

Generational wealth is something that we are not so familiar with in the Filipino community, but it’s something that we should all aspire and strive for – not only for our personal gain, but for the betterment of our future and our families. If you don’t know where to start or want to learn more, then read on.

1. Tell us about yourself, Rod.

Rod Magsino: Hello, my name is Rod Magsino. I was born in Chicago, Illinois in the early 70s and left when I was three years old when our family migrated to California to a little town called Glendora. My dad was a doctor that graduated from the University of Santo Tomas in the Philippines. He was one of the 1st in his family and in his town in Lipa City Batangas with the ambition and courage to move to America. He started his residency in Chicago in the late 1960s and ultimately was convinced and recruited by another doctor friend to move from the windy city to the sunshine state to work at Glendora Community Hospital, a new medical center at the time, looking for new doctors.

I grew up in a traditional Filipino household where there were a lot of high expectations of going to school, get good grades, and to also become a doctor, just like my dad. Unfortunately, I never took the path of being a physician. I am the youngest of three. My 2 older siblings did not pursue the medical field either. I initially was going to become the doctor in the family but I had to break the news to my parents that I was more interested in business. Ultimately, I graduated in 1997 from Azusa Pacific University with a degree in Business Marketing. With the feeling that I let my parents down by not being a doctor, I still wanted to make them proud by pursuing a “higher education” with an MBA.

It was at that point when my dad had me look into something he mentioned that was better than an MBA. I was shocked and confused thinking what could be better than an MBA, coming from a professional that has the highest of all degrees as a Medical Doctor? He then told me, "Son, I've been working hard for money all my life and I don’t want you to be in my shoes at my age working for money. ” He wanted me to understand how to be more financially literate and how money can work hard for me rather than me working hard for money. If I can learn these financial fundamentals, and not only apply it to myself but have the opportunity to teach those concepts to other people, then I can make this as a career….just as a doctor helps people go from being sick to feeling healthy, he mentioned that this field can allow me to help people going from being financially sick to financially better.

At first I was apprehensive and reluctant, because back then I was terrible with money and finances. Actually, I didn’t even know how to balance my own checkbook. Can you imagine, I had more letters than numbers in my checkbook seeing letters like “NSF” (Non Sufficient Funds)…..or “OD” (Overdraft)….or “NB” (Negative Balance)...or “OMG”….Oh my God I’m broke!! So I told myself how could I possibly be good as a financial professional when I’m terrible with finances? All-in-all, I took a leap of faith and along with the passion and enthusiasm to learn and to help people get from where they are to where they can be financially, I am still here today, after 28 years, loving what I do as a financial educator. I am a licensed Securities rep, as well as having my Life and Health Insurance license. Having the opportunity to share my knowledge and experience with others in helping to build and protect their wealth is key in establishing one’s financial foundation and security.

2. What was your relationship with money growing up in a Filipino family?

Rod Magsino: My parents came from the Philippines (earning peso) to a new country in America (earning dollars). My dad always envisioned coming to the United States to live the “American Dream.” However, as a foreign doctor coming to the states and making money, there was an image and a status my dad had to maintain, added with the pressure of keeping up with the rest of his doctor colleagues and friends. For instance, when he goes to the doctors lounge and sees one of his doctor friends that just bought a new Mercedes, he felt that he had to buy a new Mercedes. If one of his friends bought a new Rolex watch, he had to buy a new Rolex watch. If one of his friends bought a new house on the hill, he had to buy a new house on the hill. If he sees a doctor’s wife carrying a new Louis Vuitton purse, he had to buy a new Louis Vuitton purse for my mom as well. What turned out to be an American Dream resulted in the troubles and the stress of working hard for money and all the things that money could buy.

My dad sacrificed so much to provide a better life for his family….but it all came with a price. The harder he worked, the more money he made, but the more he made, the more he bought, but the more he bought, the harder he worked, and the harder he worked the more money made. It became a tiring and endless cycle for years. He had his own medical practice in 2 locations. He also worked at multiple hospitals, convalescent homes, and other health care facilities. He would work constantly. He would even sleep overnight in the hospital as he was the ER doctor on duty on multiple occasions. There was one time when I was younger that my mom told my siblings and I that we were going to have a family dinner with dad. She told us to get ready. I was excited. We thought that we were all going to a nice restaurant together as a family, but instead we pulled up to a drive-thru at KFC. I was wondering what was going on?

We ended up having dinner in the doctor’s lounge at the hospital knowing that dad only had a small time slot to spend with us. That was how our family dinners were like. My parents were very guarded and shielded us from any money problems. They didn't want us to know about all their sacrifices and financial struggles. They just wanted to provide the needs for my siblings and I and for all of us to just be happy. Sadly, I didn't see the outside of all the tough times they went through financially. They hid it so well from us.

So fast forward, when I finished college my dad told me, "Look son, now that you graduated, I want you to learn something that I wasn't able to teach you growing up." He was so insistent for me to be part of the financial industry because he realized the certain mistakes he made when it came to money and he didn't want me to repeat them. He wanted me to learn how to be more financially responsible and to build a better future by saving more and spending less.

One of my dad’s best friends, who was also a doctor, invited my parents to his home and listen to a presentation that talked about building wealth. There was a lady there who worked as a med tech for 15 years. She completely dropped her med tech job to be in the financial industry full time. My parents were listening intently to her presentation as she talked about money, finance, how to earn better returns on investments, how to minimize tax, how to build financial security, and so much more. I wasn't there, but when my parents came back home, they were so excited to share with me what they learned.

It’s amazing because although I have a Business Degree, I didn’t learn any practicalities about money in any of my classes. I believe that financial education should be taught as early as elementary school. Financial literacy should be a subject embedded in a school’s curriculum. If not, then we end up learning poor habits about money from the glamour of what we see in social media or from friends and family members who are going through their own struggle of trying to get-by or making ends meet with no real plan about money. Most people don’t plan to fail, they just fail to plan on having a better financial future.

3. What was your biggest obstacle or challenge in breaking into the Filipino community?

Rod Magsino: When I first started out, I was just 23 years old. My dad referred me to his fellow doctors and nurses, which were in large part of the Filipino community. Initially, my number one obstacle was my youth. Even though I was 23, I looked like a teenager. So, when clients looked at me, they asked me what I knew about money. They would make comments like, “I've been investing since you were in your diapers."

With my youth, also came my lack of experience. I felt there was a generation and communication gap talking to my dad’s peers. However, over the years I started to gain their trust and respect as I developed more experience, competence and confidence in the financial industry.

A lot of my dad’s friends and colleagues had the same habits of working hard, spending money, driving nice cars, buying luxurious brands and racking up more debt than savings. On the outside everything looked great, but on the inside, no one really sees the struggle and the pain behind it all. I had to set aside the challenge of any age gaps or communication barriers and ended up speaking a new language of financial literacy that could better their financial future.

There was one doctor in particular that I met. He apparently was very successful living in a beautiful home, having the Mercedes Benz in the driveway, the crystal chandelier in his foyer, the Lladro porcelain figurines and the Italian furnishings in his living and dining room. He lived a very lavish lifestyle. He was 57 years old and had no money set aside for his retirement. He was asking me what he needed to do to save and get ahead. When I shared with him some strategies of cutting down some expenses to create a surplus to save, he was resistant. He never did invest and never became my client. Sadly, he is still working till today being in his 80s.

The choice can be simple: You either tighten up your belt, minimize your expenses and pay into your long term savings as much as you can NOW, in an effort to enjoy your retirement and play later…..versus playing NOW, spend all your money, yet end up paying for it later by extending the amount of years you need to work until you die. It’s all about pay now, play later or play now, and pay later. Either way you’re going to pay. In the case of the 57 year old doctor, he played first. That's why he's paying for it now.

4. What are the common themes that you see in the Filipino community when it comes to money?

Rod Magsino: Over my career, there has been 2 different and distinct Filipino generations that I have served: My dad’s generation, the 1st generation immigrants who migrated from the Philippines to the U.S. and our generation, the 2nd generation immigrants who are the kids that were born in the United States from parents born abroad. From what I’ve seen in my dad's generation, is that they live similarly to their counterparts who migrated at the same time from the Philippines. They all wanted to live the “American Dream,” living in big houses, driving the nice cars, and owning fancy things. They spend money they don’t have, to buy things they don’t need, to impress people they don’t even like. They work multiple jobs and long hours. Their kids hardly see them and were taken care of from their Lolo’s or Lola’s or their Tita’s and Tito’s who lived in the same household. Working hard to maintain a certain status and image was important to that generation.

In contrast, my Filipino clientele who are part of the 2nd generation, they have a stance where they don't want to make the same financial mistakes as their parents who didn’t save much for their future and retirement. The younger generation has more of a minimalist mentality. They think twice in purchasing name brands. If they did, then they would go to Ross, Marshalls or TJ Maxx. Looking good…on a budget. I noticed that they are more frugal between buying something they want versus something they need. As such, they're tucking away more money for their financial future than their parents ever did. It’s pretty interesting to see the difference between the two generations within the past two decades. The younger generation is more concerned about their finances and asking a lot of questions about saving and making money. They want to know how certain financial products work? What's the difference between this retirement plan and that retirement plan? This life insurance versus that life insurance? Putting money in this investment versus putting money in another type of investment and earning certain rates of return?

My dad’s generation was more avoidant. When I asked them personal questions about their finances, they didn't want to answer because they were either kind of embarrassed or they didn't want to expose how much they're really spending.

Although I see the differences, the common thread between the 2 generations is that they will sacrifice and do anything to make their kids happy and live a better life financially than they ever had for themselves.

5. How did you get your dad’s generation to start investing money?

Rod Magsino: From the moment that my mom and dad attended the financial presentation at their friend’s house, they were completely blown away from all the financial knowledge and information that was shared that fateful night. They left their friend’s home excited yet disturbed of why they didn’t start things any sooner. My mom and dad were eager to make drastic changes. They became passionate to advocate the importance to save and build wealth. I caught on to that same passion and got my license to become a financial professional. So as I started out in the financial industry my parents introduced and referred me to their peers and colleagues who were doctors, nurses, therapists, or other health care professionals and business owners. I was fortunate over the years to be able to help my parent’s friends and colleagues with their financial education and goals, which in turn, gave me the opportunity to talk to and be referred to THEIR friends and colleagues as well. Just as a pebble is thrown into a pond, you see that same ripple effect that spread over the multiple generations served.

6. How can Filipinos build and pass down generational wealth like we see in other cultures?

Rod Magsino: Bill Gates once said, “If you are born poor it is not your mistake, but if you die poor, it is YOUR mistake.” I believe that people have to have a good understanding and be educated on the importance of finance. There are so many resources out there to learn. Although knowledge learned and knowledge applied can make all the difference between passing down either generational wealth or generational poverty.

There are many avenues to create and pass down wealth, whether it be through life insurance or establishing a retirement plan and assigning rightful beneficiaries. Please consider though consulting proper professionals in the field of estate planning, like estate attorneys, CPAs, etc. I, nor TFA, offers any legal or tax advice or estate planning services. However, it is such a crucial piece for a family to explore as part of their overall financial strategy.

7. What advice do you have to someone who wants to get started in learning more about finances and wants to get started with investing?

Rod Magsino: One could start by building the interest and desire to learn about financial literacy. Listen to various podcasts, watch certain videos or read good books that peak your interest in the areas of finance that you’re interested in, be it through life insurance protection, managing debt, creating an emergency fund or building proper investments through college planning or retirement. Secondly, be conscious of what you spend versus what you save. For example, if you spend a lot of money going to Starbucks, eating out, or Amazon shopping…what if the money spent on those items can now be minimized and reallocated as a surplus to start saving and accumulating wealth. Thirdly, be aware of the “Catching up with the Jones’” or “Keeping with the Kardashian” syndrome, by spending money you don’t have to buy things you don’t need to impress people you don’t really care for. And lastly, talk to a financial professional with experience, integrity and who's trustworthy about how to build a better financial foundation and future.

8. What services can you provide for others as a financial professional?

Rod Magsino: There’s a vast diversification of financial services that can be offered. I am part of a broker dealer and an insurance agency that represents a multitude of insurance and investment companies and products in the industry. I have both my securities and my life and health insurance licenses. Having both licenses allows me to help individuals, families, professionals and business owners with their investment and / or insurance needs in areas of retirement, college plans, mutual funds, annuities, life insurance and much more.

9. What's the entry point for someone who wants to just get started?

Rod Magsino: One of my favorite quotes from Warren Buffett is “Someone is sitting in the shade today because someone planted a seed a long time ago.” The hardest thing about starting is to just simply START. If one can SAVE the money they usually spend on a cup of coffee or on a combo meal, the compounding effect on the growth of that money can be substantial, especially over a long period of time. Can you imagine, all that money that one could have earned, ended up going to Starbucks, Mc Donald’s, Chili’s, Amazon, etc. If one uses the power of compounding interest, coupled with the right discipline, habit and focus, then the shade they build for themselves when they hit retirement age, can last them a lifetime.

10. What’s the craziest financial situation you’ve heard people get themselves into, where they’ve come to you for help?

Rod Magsino: There is a common phrase that some people mention that “money is the root of all evil.” I’ve certainly seen what an abundance of money can do and what a lack of money can do to certain individuals and families in a good, bad and sometimes ugly way. I’ve seen the greed of how money can break up and tear down families, but on the flipside, I have certainly seen many good things of what money and proper preparation can do for overall financial goals. One amazing story to share is a case that I feel particularly touched. I had a client of mine who was a dishwasher in the kitchen. He ended up opening a life insurance policy for $500,000. He was going through a divorce and had two young kids at the time, 12 and 10 years old, whom he designated as his beneficiaries. Seven years later, he got diagnosed with cancer and sadly passed away. His two kids, upon his passing, were ages 19 and 17. I contacted his eldest child, which was his daughter, to visit me at my office. As she sat across my desk, I told her that her dad left something behind for her. I had a large envelope in my hand, and as I opened it up, I slid over to the young daughter her portion of her dad’s life insurance, a check in her name for $250,000. The 1st thing I told her is “Don’t be stupid!” I didn’t want her to take all the money and spend it on a nice car, a house, or on fancy purses.

Instead, I wanted her to be financially literate and save a big chunk of it, just as her dad had intended for her to use the money. Luckily, she was smart enough and responsible with the money. She used a big portion of the money to pay for her college education with her undergrad studies at Cal State San Bernardino and ended up completing her graduate school at the University of San Francisco, all with no college loans. She took the other portion of her inheritance and had the discipline to save and invest it. I am so proud because the young lady is now 32 years old, a career woman, with a good job and recently got married. Over the years of saving, she was able to diversify her investments with life insurance, mutual funds, retirement plans like a ROTH IRA and annuities. Her diverse portfolio has given her the chance to have more confidence and feel more stable with her financial future. Can you imagine, she was just 12 years old when I first met her with her dad. It’s remarkable though that the seeds her dad left behind, will continue to build for her and her family a shade of generational wealth and financial freedom.

11. Now that you're a dad, do you teach your children about finances?

Rod Magsino: Absolutely. I have 3 kids. A 23 year old son and twin daughters that are 8 years old. Good or bad, I believe that the foundation of learning about finance and money stems from what we observe from our parents. When I was younger, as I mentioned earlier, I saw my mom and dad make a lot of money, yet spend a lot of money. So growing up, I would follow the same path. Go to work > Earn Money > Spend Money. Go to work > Earn Money > Spend Money. It was a vicious cycle because the times I would run out of money, I still would be spending by using…..credit cards…..which, of course, I can “conveniently” pay later. That mentality eventually created a big financial hole which was difficult to climb out of.

My dad knew he needed to make change and be a better example, so once I was encouraged by my parents to be in the financial industry I was able to apply better disciplines going from spending to saving and adjusted my buying habits, telling myself, is this something I really want or is this something I really need?

So all-in-all, as MY kids grow, I want them to see a good example of financial security and responsibility so it can ultimately rub off on them to be and do the same.

Never do we want as parents to have our kids make the same financial mistakes as we did in the past. I am very proud that my son has developed a good foundation with money and finance ever since he was young. When he first started a job in high school, I told him….“Son, when you get your paycheck, it’s either you spend money 1st and save what’s left over or you save your money 1st and spend what’s left over.”

He understands to be careful on what he spends his money on. He’s excited to see the potential of what savings, compounded over time, can do to build a substantial nest egg in the future. I would teach him that if he were to simply take the money he would spend on shopping or eating out, and set it aside and save it for the long term, he would then have the ability and control to make himself rich, rather than companies like Amazon, Nike, Chipotle or Starbucks rich.

With my twin daughters, my wife and I are very careful of how they view mommy and daddy spend money. Do they watch us splurge? Do they see us wanting and buying the latest fashion, electronic gadget, designer hand bag or watch? When they were much younger, we bought them a plastic see through piggy bank. My wife and I gave them incentives that if they save up to a certain point in their piggy bank then we would reward them, either with a toy or ice cream. The more they saved and reached a higher mark on the piggy bank, we would give them a bigger reward. What that did was teach them the importance and the patience to save. We made savings fun!!

12. What does it mean to you to be Filipino American?

Rod Magsino: I'm proud to be Filipino-American. It's great to be in America where you have the freedom to DREAM BIG and to have those dreams materialized from all the opportunities and abundance that America has to offer.

My parents grew up in the Philippines with very humble beginnings. They sacrificed and left the comforts of a world so familiar to them, to come to the United States to provide a better future for their family. The Filipino beliefs, traditions and values of humility, kindness, joy and faith that my parents passed down to my siblings and I, not only are well cherished but also, well practiced. If my mom and dad never made the decision to leave the Philippines, I cannot imagine where our life would be today. Their legacy lives on!! Mabuhay!!

13. Where can people find you?

Rod Magsino: People can find me on the following link or scan the QR Code below. Thank you Jenn for a wonderful interview. I cherish and appreciate having the opportunity to know you, your mom and sister over the over the years and look forward to continue the long-term relationship with you and your family for many more years to come in building and protecting wealth.

https://financialprofessional.tfaconnects.com/roderick-magsino

The Legal Stuff, because we have to:

Many people have experienced various levels of success with TFA/WFG. However, individual member experiences may vary. This statement is not intended to nor does it represent that any current member's individual results are representative of what all participants achieve when following the TFA/WFG system.

This material is intended for education and training purposes only and is not intended to be, nor should it be construed as, an offer or solicitation for the purchase or sales of any specific securities, financial services or other non-specified item.

This testimonial as well as the statements and opinions presented are those of this particular client and/or agent and are unique to this individual. Experiences vary and the ones expressed here may or may not be representative of the experience of others, and they do not guarantee future results or experiences by other clients or agents. The testimonials are provided voluntarily and the individual providing it was not paid nor were they provided with any other benefits, monetary or otherwise, in exchange for their statements.

Jennifer Redondo is not affiliated with TFA, LLC.

Securities are offered by Transamerica Financial Advisors, LLC., Member FINRA, SIPC.

4615532-0725

Written by Jennifer Redondo

Co-Founder and Co-Author of In Her Purpose

When the Avengers: Doomsday one-year countdown dropped, audiences didn’t just watch. They paused, replayed, shared, and even speculated about hidden messages. A week later, the clip surpassed 14 million views, becoming a viral moment picked up across major media outlets that fueled anticipation for the next chapter of the Marvel Universe.

The countdown video was the result of a collaborative effort led by AGBO and its studio partners. Supporting the marketing team as a contracted editor was Joshua Ortiz (@joshuajortiz), a Filipino American filmmaker whose career has steadily built toward opportunities to contribute to projects of this scale, alongside earlier success with the short films he has written and directed.