Top 4 Things I Wish I Knew When I Was Younger - Finance Edition

I recently entered into a new decade. Now that I am “mid-life”, I often catch myself saying, “I wish I would have known that when I was younger,” especially when it comes to money and finances.

I am sandwiched between two generations: those just trying to survive and make it in America and those pursuing their passion and living life to the fullest. I fall somewhere in between – I went to college, landed a stable job with benefits, and still work hard.

Growing up in a Filipino family, talking about money was taboo- and the most important thing was to work hard and make it. I learned Finance 101 through music and my personal “adulting” experience. Here’s a list of concepts that I wish I had grasped at a much younger age. Whatever stage you’re in, I hope that this will help guide you down a path to financial literacy and eventually, financial or time freedom.

Money Management

Good Credit Scores

Debit versus Credit Cards

Investing in Yourself and Building Generational Wealth

Money Management

It’s not about how much you make; it’s what you do with what you make. Knowing your numbers is key! Do you know your monthly expenses (housing, transportation, food, insurance, utilities, entertainment, subscriptions, etc.)? If you don’t, it’s time to create a budget.

I mentor many young adults, and the advice I give them is: to live like a college student “trying to make a dollar out of fifteen cents” (2PAC). Just because you’re making more money does not mean you have to spend more. When you start to acquire more money, it’s really tempting to upgrade to a fancy car or designer purse. There’s nothing wrong with treating yourself, but make sure not to give into lifestyle inflation. Control yourself before it gets out of hand! Biggie said it best, mo’ money, mo’ problems: the more money we come across, the more problems we see.

There are two professionals that I recommend everyone have on their squad: a financial planner and a certified public accountant (CPA). There’s a myth that you need money to hire a financial planner, which is not the case. Financial planners get paid hourly or by the performance of your investments. A financial planner can help you build a budget and get you to start investing. CPAs are also critical because they help you understand taxes, guide you on what you can write off, how to lower your taxable income, and how to keep as much money as you can.

2. Good Credit Scores

Good credit is everything! Your credit score will dictate your buying power. Before Beyonce was Yonce, she was with Destiny’s Child singing:

“Can you pay my bills?

Can you pay my telephone bills?

Do you pay my automo’ bills?”

Having good credit can make all the difference when it comes to applying for your first job, submitting an application to rent an apartment, buying a cell phone, establishing utility bills, and eventually larger purchases such as a car or home. Lenders look at your credit score to identify how big of a risk you are to them. In order to get credit, you have to establish credit. The sooner you start, the better.

As I was building my credit, I opened credit cards at stores I frequented. In order to keep my spending at bay, I made the biggest mistake by closing most of my credit cards. Closing a credit card will reduce your total credit limit and will cut off your history. Lenders want to see that you are paying your bills on time, and that you are responsible enough to control your spending with the limit increases. Take care of your credit so that it’s strong when you need it.

Make sure to check your credit score on a regular basis. It is important to monitor what’s being reported, and also to make sure that there aren’t errors or surprises like your identity being stolen. You are entitled to three free credit reports a year so be sure to add that to your annual check up list.

3. Debit vs. Credit Cards

Debit cards and credit cards are not the same thing. Debit cards deduct money directly from your checking account. You cannot spend more than you have in the bank. Credit cards give you access to a line of credit and is protected against fraud. Learn from Kanye:

“I want to act ballerific like it’s all terrific.

I got a couple past-due bills, I won’t get specific

I got a problem with spendin’ before I get it.”

You should treat credit cards like debit cards. Only spend what you have the ability to pay back immediately. Do not spend money you don’t have. If you can’t pay your credit card bills in full, on time, you will end up paying more for that item simply due to the interest accumulated.

Interest is the amount that credit card companies charge you to borrow money. If you don’t pay your balance in full, you end up paying interest on the outstanding amount. This is how credit card balances grow and can get out of hand.

4. Investing in Yourself and Building Generational Wealth

Understanding interest is very important. Credit cards and loans are examples of simple interest rates, but there’s also compound interest which is best explained by Jay-Z:

“You already know, you light, I’m heavy, roll heavy dough

Mic-macheted your flow

Your paper falls slow like confetti

Mines a steady grow”

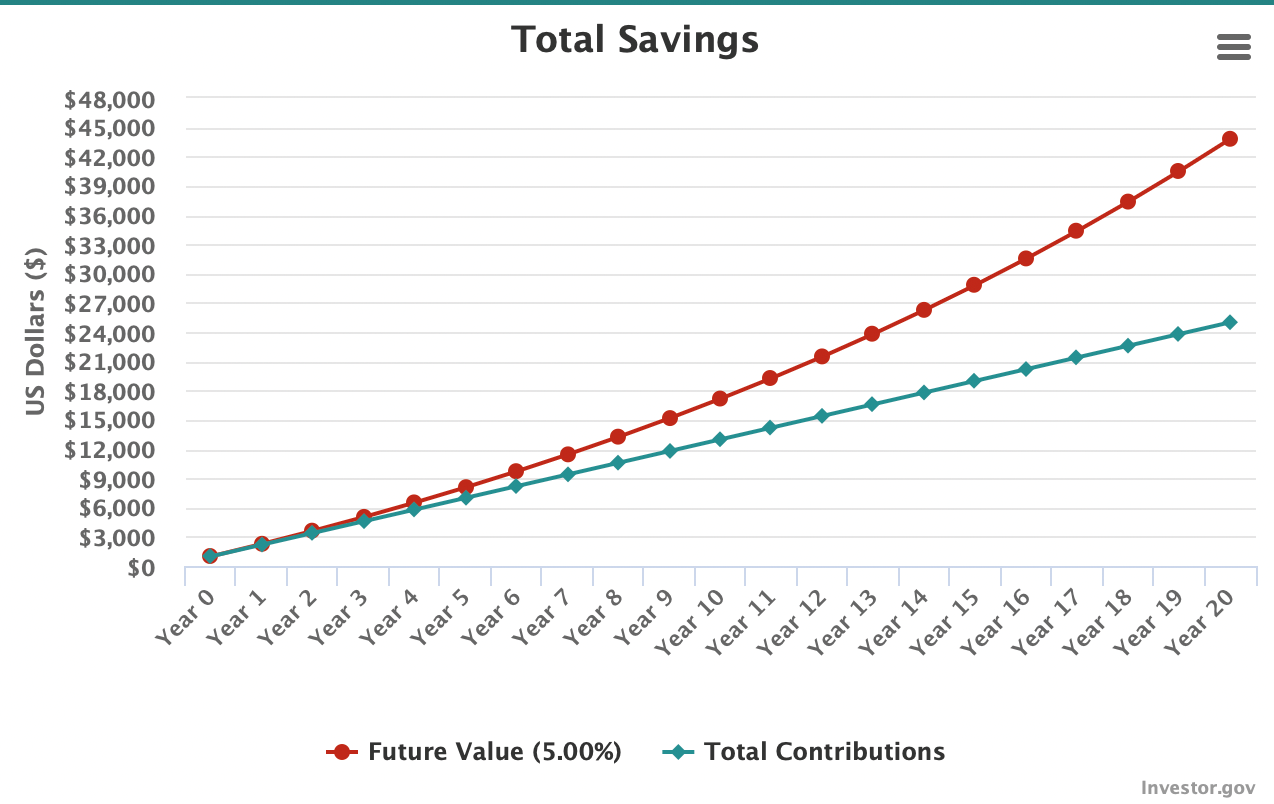

Compound interest means that your money will grow larger over time. The more time you let compound interest work it’s magic, the more you’ll see in your account. Compound interest is basically interest on interest. For example, if you invest $1,000 at 5% interest and contribute $100 each month, compounded monthly for the next 20 years, you will end up with $43,816.01.

You get the point. You have to be patient and you have to be disciplined enough not to touch that money. Many experts tell you to pay off all of your debt first, but I believe that you should pay yourself first. Spend what is left after saving. The easiest way to do this is by automating your investments, which your financial planner can help you with. When you make more money, instead of spending more, invest more. Your future self will thank you and you’ll understand why Biggie is so proud to say: “Damn right I like the life I live because I went from negative to positive.” He was definitely wise beyond his years.

I had to be young before I could be wise. Always be curious and keep an open mind. There’s the traditional way of acquiring knowledge through textbooks and school, but every opportunity is a chance to learn whether that’s through conversations with strangers, podcasts, or even lyrics to songs. Most importantly, don’t be afraid to bet on yourself and remember to invest in yourself first. No Return on Investment (ROI) is profitable if you have to invest your entire life to earn money. After all, time is money.

Written by Jennifer Redondo

Co-Founder and Co-Author of In Her Purpose

You might like to read more about

For many, watching Kelsey Merritt’s career unfold has been something of a hobby. The first Filipina to achieve a number of unbelievable career feats.

We’ve put together a few of our favorite things for you to get to know this powerful pinay better

Read More